Chartered Financial Consultant® (ChFC®)

Since 1982, the Chartered Financial Consultant has remained the most extensive education available for professionals seeking a designation in financial planning. More than 41,000 individuals have attained this distinction, enabling them to effectively apply a comprehensive financial planning process to their clients’ needs.

Individuals with the ChFC designation have demonstrated their vast and thorough knowledge of financial planning. The ChFC program is administered by the American College. In addition to successful completion of an exam on areas of financial planning, including income tax, insurance, investment and estate planning, candidates are required to have a minimum of three years experience in a financial industry position.

Like those with the CFP designation, professionals who hold the ChFC charter help individuals analyze their financial situations and goals.

Individuals with the ChFC designation have demonstrated their vast and thorough knowledge of financial planning. The ChFC program is administered by the American College. In addition to successful completion of an exam on areas of financial planning, including income tax, insurance, investment and estate planning, candidates are required to have a minimum of three years experience in a financial industry position.

Like those with the CFP designation, professionals who hold the ChFC charter help individuals analyze their financial situations and goals.

Do you find that there never seems to be a convenient time to put money aside for savings, investment, or insurance?

Most people spend first... and try to save and invest what little is left

Most people spend first... and try to save and invest what little is left

Few people set aside a definite amount first... and spend the balance

They are the ones who have money when they really need it

Why can't we save money?

The answer is within yourself. Identify your weakness. Some of the reasons could be:

Why can't we save money?

The answer is within yourself. Identify your weakness. Some of the reasons could be:

- Poor earning capabilities

- Too many debts - credit card, loan installments: personal, car, computer, furniture etc

- Excessive spending

- Luxury items, over-budget (no budget at all) e.g. must have latest mobile phones, laptops etc

- Frequent holiday trips

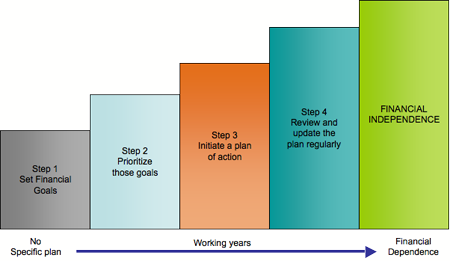

How do we make sure we save first then spend? In other words, how to be financially successful?

BUT the LONGER we WAIT...

THE STEEPER THE CLIMB

Blogged with Flock

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment